Products

With Atto, make better risk decisions across the entire customer lifecycle.

Smooth, clean, secure connect journey

A guided user-interface to capture consent, verify and connect to bank accounts, and share transaction data.

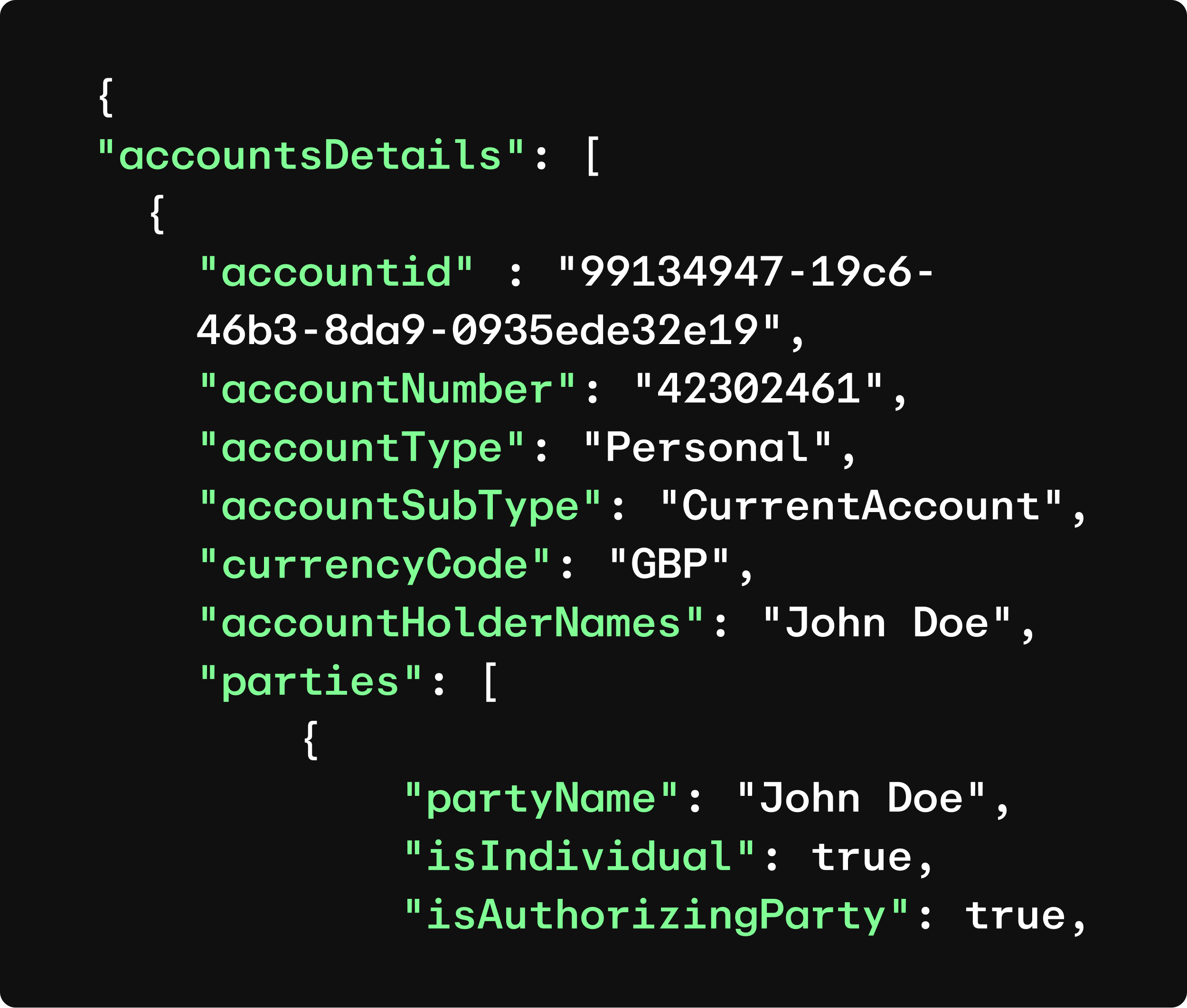

Data APIs

Access to normalised and enriched bank statement data that can be integrated into your own systems

Welcome to the most up-to-date data dashboard

See what your customers are spending, saving and earning today with Atto.

Atto insights

Understand how your customer’s spend, save and earn their money with real-time insights.

What our customers say

Get started using open banking data

Talk with one of our specialists to find out more about using open banking data.

Demo of the guided customer consent journey

Walk through of our real-time data & insights

Coverage check in your markets

Frequently asked questions

What is open banking and how does it work?

Open banking is the practice that allows people and businesses to share up to 12 months of transaction data. Atto is regulated by the Financial Conduct Authority as an Account Information Service Provider (AISP) - the intermediary who safely facilitate this process.

What is transaction categorisation?

Transaction categorisation is the process of adding context to raw transaction data. The process gives you an understanding of what your customers' spend their money on and where.

Read moreHow does bank account verification work?

Using the API, A matches the details provided from your customer to those on their account. We apply a set of sophisticated algorithms and rules to verify the name, and then tell you what does and does not match.

Read moreHow do you verify income with open banking?

After a customer shares their data, Atto identify recurring credits to the account and group these. Using an algorithm we identify the monthly income for each income stream. We then return the calculated income and confidence score to you.